Renters Insurance in and around Cary

Renters of Cary, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Apex NC

- Raleigh, NC

- Morrisville, NC

- Durham, NC

- Sanford, NC

- Springlake, NC

- 28307

- Fuquay-Varina, NC

- Holly Springs, NC

- Pittsboro, NC

- Carthage, NC

- Clayton, NC

- Knightdale, NC

- Lumberton, NC

- Fayetteville,

- Benson, NC

- Goldsboro, NC

- Siler City, NC

- Greenville, NC

- Smithfield, NC

- Rocky Mount, NC

- Pinehurst, NC

- Southern Pines, NC

- Rockingham

Calling All Cary Renters!

Think about all the stuff you own, from your bicycle to clothing to pots and pans to tools. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Cary, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Why Renters In Cary Choose State Farm

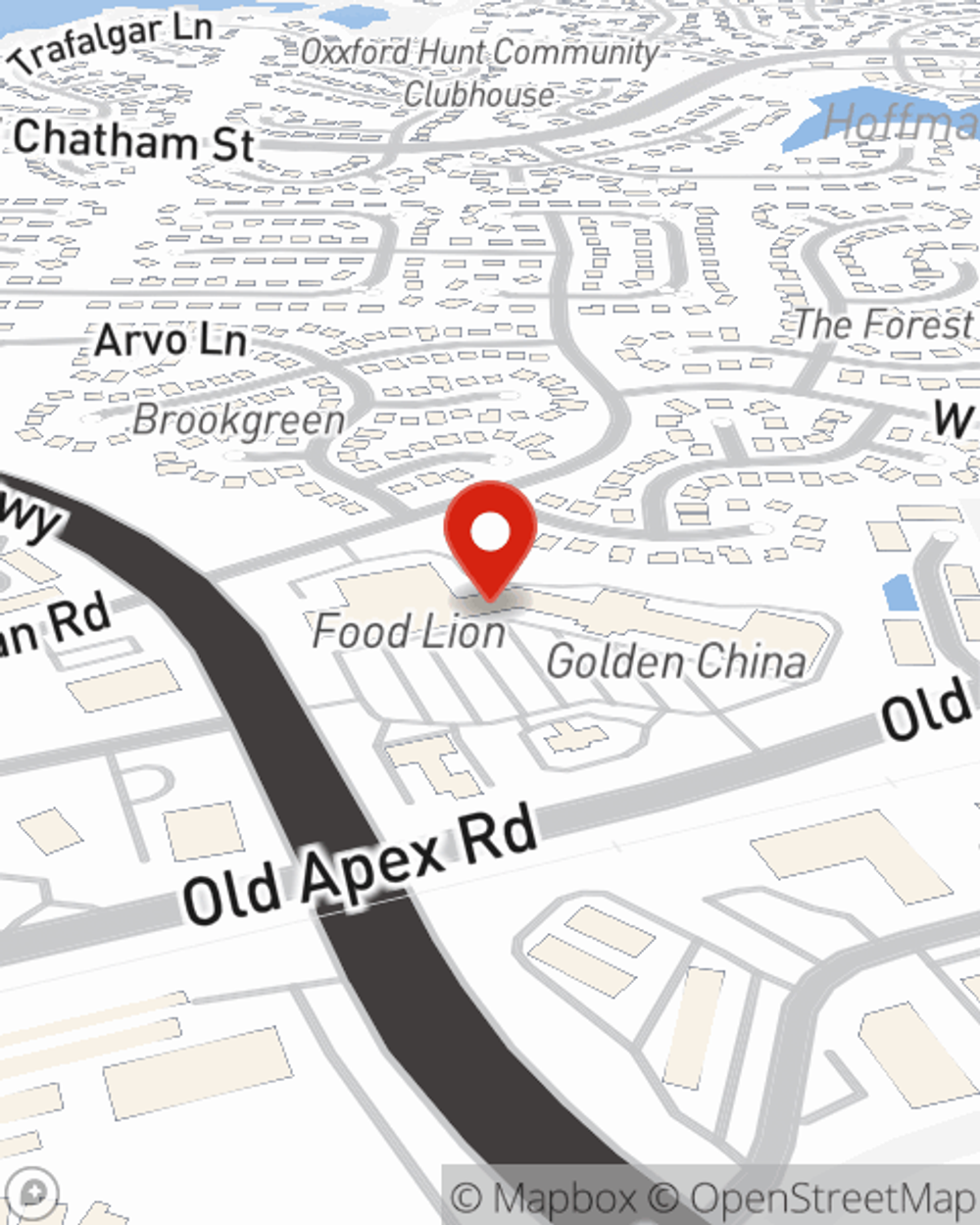

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Brandon Garcia can help you generate a plan for when the unexpected, like an accident or a water leak, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Cary. Call or email agent Brandon Garcia's office to discover a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Brandon at (919) 238-4439 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Brandon Garcia

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.